G2 recently released its annual Software Buyer Behavior Report that includes some important key takeaways around 2022 SaaS spending, and the impact of shadow IT on SaaS security.

We surveyed 1,002 B2B decision makers across the range of levels from individual contributors to C-level executives. Our research included a diverse set of SaaS buyers in all industries and organization sizes across the globe.

Key Findings

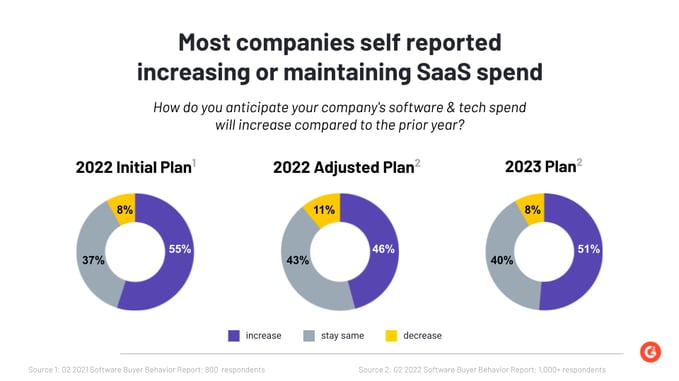

- 51% of organizations expect spending to increase over current levels in 2023.

- SaaS spend is up 15% quarter over quarter from the same quarter in 2021.

- 56% of enterprise-sized organizations report use of software that wasn’t properly vetted by IT or security.

Against this background, let’s dig into what the research, along with G2 Track internal data, tells us about 2022 SaaS spending, Shadow IT and the SaaS security risk that rides along. We’ll close on how our data points to why every organization should consider SaaS spend management software.

Surprise! SaaS Spending isn’t slowing down

It’s been a bumpy economic ride in recent months, but there’s one thing that isn’t bumpy: SaaS spending. It seems to be steady and in some cases increasing.

Bucking the conventional wisdom we’d expected during leaner times, SaaS budgets aren’t being cut for next year. In fact, 51% of organizations expect spending to increase over current levels in 2023.

Of course, 2022 did see some budget adjustments from what was expected. At the beginning of the year, 55% expected to increase what they spend on the SaaS apps that power their organizations. Meanwhile, 37% expected investments to remain the same.

As 2022 unfolded, research showed a change in SaaS spending

Instead of 55% of organizations expecting to increase spending, 46% of organizations actually did this far into 2022.

Reality crept onto the scene. This was likely driven by:

- SaaS buying processes that are increasingly complex,

- Unstable headcounts thanks to the Great Resignation, and

- Business climate uncertainty.

That makes a difference of 9% between what was expected and what occurred. What happened to that group? Of that 9% difference, 6% kept SaaS spending the same in 2022.

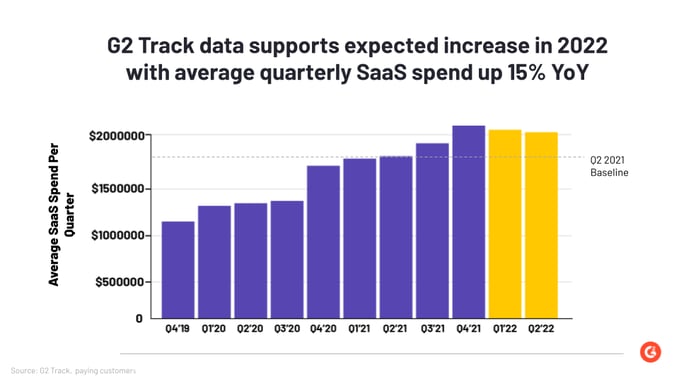

According to G2 Track Data, 2022 SaaS Spend is up 15%

Turning to a different data source for 2022 SaaS Spend, let’s look at data from SaaS management platform, G2 Track.

Since our discovery engine is about as comprehensive as it gets, we are able to track trends in SaaS spend. G2 Track is powered by the world’s largest SaaS product taxonomy at G2.com, so no SaaS app can ever hide from us. Late last year, G2.com predicted that SaaS spend would continue to increase, and our data here at G2 Track backs that up.

By looking at this data source, year over year – from Q1 2022 over Q1 2021, there’s a 15% increase.

This key finding also supports the Software Buyer Behaviors Report conclusions – 2022 SaaS spending is stable and growing, and this trend is expected to continue into 2023.

More SaaS- with Shadow IT - Brings More Security Risk

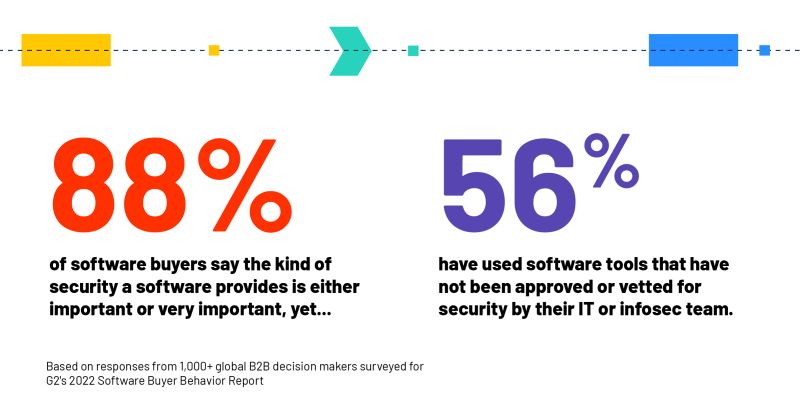

With a growing SaaS environment, comes a security risk that grows as each new app or new user is added. And most organizations instinctively know that the security a SaaS app provides is crucial.

After all, our research shows that 88% of software buyers say that it’s either important or very important.

Some of that risk is due to Shadow IT and the G2 research shows it. An alarming 56% of respondents admit to using software tools that have neither been approved or vetted for security by their IT or infosec team.

This is known as Shadow IT.

Shadow IT Means Unknown Security Risk

On one hand, it’s great that SaaS gives users a hand in their own productivity and improves the employee experience. But on the other hand, it introduces unknown SaaS security risk.

Within only minutes, a user can add a new app with:

- Security vulnerabilities,

- Improper security technologies or processes,

- Security policy violations,

- Inappropriate data read/write permissions,

- Ability to collect and store sensitive data, and

- Integration with another app that stores sensitive data.

According to the research, Shadow IT’s security perils are especially acute for larger organizations. Nearly 56% of enterprise-sized organizations report using software that wasn’t properly vetted by IT or security. In the mid-market, 58% confess to using unapproved SaaS apps.

This trend appears more often in North American markets, at 62% and slightly less in the EMEA (54%) and APAC (48%) markets.

The reason for this lies, partly at least, in the purchasing process.

Flexible Procurement Encourages the Shadow IT that Grows Security Risk

At 56%,North American organizations prefer to purchase software with a credit card. Meanwhile, in APAC and EMEA- 40% and 41% respectively – they tend to buy using a credit card less often than their North American counterparts.

Regardless, you can’t blame the expansion of Shadow IT and its byproduct - increased security risk -- on the corporate credit card alone.

The growth of remote work makes it all too easy to use unapproved and unsecure software. While the company, of course, is on the hook to pay the bill.

There are three trends:

- The rapid growth of SaaS,

- Easy and flexible procurement, and

- The new remote workplace,

These trends work together to foster Shadow IT that only brings security risk.

SaaS Spend Management Solutions are Gaining Ground

SaaS Spend Management is still a relatively new software category. It’s been around for a few years now, and SaaS spend management solutions come in many flavors. While these tools vary in features and functionality, most tools have some common capabilities.

But first, what is this category?

According to G2.com, they define SaaS spend management solutions as “tools used to manage and control software as a service (SaaS) costs.”

This class of solutions perform many functions, namely:

- Discover all SaaS where there is spend,

- Centralize visibility over all SaaS subscriptions, and

- Show utilization and allocation.

All with a goal of being able to Identify unnecessary spending on SaaS apps with low utilization, multiple accounts of the same tool, or tools with similar use cases.

Back to the G2 Software Buyer Behavior Report, it reveals that only 13% of buyers say they use software to track their SaaS adoption.

The truth is, though, by not using SaaS spend management tools, organizations are losing out on their many benefits.

Why? Because the best SaaS spend management apps help organizations with some important activities like:

- Identifying ALL commercial SaaS apps and compatible integrations in your environment,

- Understand usage for each SaaS app,

- Control SaaS spending,

- Forecast and plan software budgets by organization, department, and employee,

- Collect employee sentiment using fast, short surveys to get feedback on the tools they use,

- Monitor and track SaaS licenses and renewals,

- Deliver actionable insights on all license, usage, and spending data, and

- Manage license authorization and requests in one place.

In the coming year, as SaaS continues to expand into every organization's operations, it’ll become increasingly apparent that a SaaS spend management platform is an operational necessity.

by Sagar Joshi

by Sagar Joshi

by Mara Calvello

by Mara Calvello

by Mara Calvello

by Mara Calvello