We’re told as kids that if you don’t have anything nice to say, don’t say anything at all.

But what if you’re working with terrible software? When this is the case, you need to speak up.

When it comes to your business and its rapidly growing tech stack, you must know how your employees feel about the tools being used, if they find them to be easy to use, and if these tools are critical to their daily workflow.

To find out more about the user sentiment of the tools within your tech stack, it’s in your company’s best interest to employ a SasS system of record that includes employee pulse surveys to get to the bottom of how people really feel about the software they’re using.

When your business collects user sentiment data, you’re asking employees or team members what software tools are actually worth having, using, and paying for. One of the best ways to gather this kind of data is to send out an employee pulse survey.

These surveys offer team members the opportunity to share their feedback directly with decision-makers as a way to adjust the tech stack within the organization. This provides businesses the chance to not only grow company culture, but also boost employee trust and keep communication about software solutions front and center.

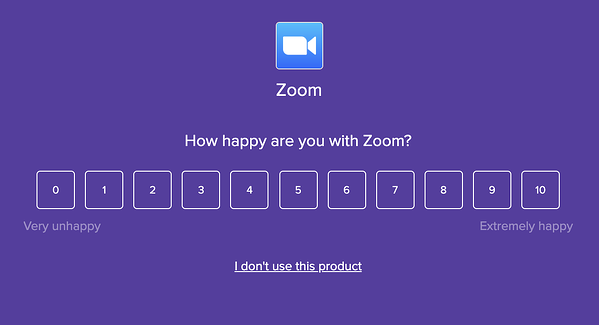

Pulse surveys make accessing data points around your employees’ opinions about the software they’re using extremely easy. Once employees receive the pulse survey email, they’ll be asked to rank how happy they are with specific software, on a scale from 1-10, as well as the opportunity to share whether or not it’s a critical tool for them to be able to do their job.

The answers received from these surveys will then provide an internal Net Promoter Score (NPS). An NPS is a satisfaction benchmark that is obtained through a one-question survey, with the purpose of knowing how happy an employee is with certain software.

In addition to a follow-up question asking how critical the tool is in regards to daily responsibilities, the pulse survey will also prompt the survey taker to elaborate more on what features they may enjoy or dislike.

To fully understand why user sentiment data is a must, let’s consider an example.

It’s not uncommon for different teams within your organization to use varying software solutions that have the same purpose or features. For instance, does your marketing team use one travel and expense software while your sales team uses a different tool within this same category? Not only are you paying for two separate tools that perform the same set of functions, but chances are that the pulse survey will result in two different scores and sentiments.

A pulse survey allows your company to take a deeper dive into sentiment data to find out which of these travel and expense tools your employees use has a higher NPS while also determining what solution is worth keeping or eliminating.

Because having this sentiment data makes it possible for your business to see which software has a low internal NPS and is not considered to be critical, you’ll be able to pinpoint which tools are an obvious candidate for cancellation, giving you an opportunity to save on software spend. You can easily reduce your costs of software by eliminating non-critical and low-rated products from your tech stack and your budget.

Once you have responses from your employees, the pulse survey will provide you with four possible outcomes based on the generated NPS.

Having this user sentiment data gives you the ability to know what your team likes and dislikes about each software application before software contract negotiations come around. As you conduct contract negotiations, you can go into each meeting knowing exactly which features your team finds valuable and those you can do without.

When you have this information, you can start a conversation with the company to see if there’s anything they can do about updating the software to make it more viable or critical for your company.

For instance, if employee feedback from the pulse survey indicates that users found social media integrations within data visualization software too difficult, you can bring that information into the negotiation and see if there’s any likelihood that this feature is going to be updated to become more user-friendly. Otherwise, you may start to look elsewhere for a data visualization solution that makes this an easier process.

It would also be helpful to see which tools get a low Net Promoter Score, indicating users do not enjoy the tool, but with a high criticality score. This indicates that it may be time to shop around for a different software solution, and you can know ahead of time that it’s not an application that should be renewed.

of purchased software products have a user satisfaction rating lower than 4 stars.

As an innovative SaaS spend management software solution, G2 Track makes a lot of things easy, and one of its latest features is the utilization of pulse surveys. As the fastest and easiest way to ask your employees what they really think about products in your stack, nothing will ever take you by surprise.

Thanks to this latest feature, users of G2 Track will enjoy:

Once you have enough data from the pulse surveys for a sentiment summary, you’ll be able to see which products fall within the four possible outcomes, how much you could be saving, and a list of the top 10 software solutions that aren’t critical and your team isn’t happy with, so you know exactly where to start eliminating. This top 10 list will also show the annual spend for each tool, giving you a better idea of how much you can save if you were to eliminate them.

In the G2 Track dashboard, click on any tool that has data within the Sentiment Hub to see when the survey was sent out, how many survey responses the application received, its NPS rating, the percentage of reviewers who found the product critical to their work, and any comments users left.

You’ll never know how your employees and team members truly feel about certain software until you take the time to ask. Pulse surveys take the guesswork out of if a tool is critical or just “nice to have”.

Consider how much you could save on software with accurate and up-to-date user sentiment data at your fingertips.

Looking for even more ways to save money? Take advantage of our free tech spend analysis to audit your software costs and license usage with a customized savings report.

Mara Calvello is a Content and Communications Manager at G2. She received her Bachelor of Arts degree from Elmhurst College (now Elmhurst University). Mara writes content highlighting G2 newsroom events and customer marketing case studies, while also focusing on social media and communications for G2. She previously wrote content to support our G2 Tea newsletter, as well as categories on artificial intelligence, natural language understanding (NLU), AI code generation, synthetic data, and more. In her spare time, she's out exploring with her rescue dog Zeke or enjoying a good book.

To renew or not to renew? That is the question.

by Mara Calvello

by Mara Calvello

From Microsoft Excel to Google Sheets, you might consider yourself an expert in navigating...

by Mara Calvello

by Mara Calvello

No matter the size of your business, it’s crucial to have accurate employee and user...

by Mara Calvello

by Mara Calvello

To renew or not to renew? That is the question.

by Mara Calvello

by Mara Calvello

From Microsoft Excel to Google Sheets, you might consider yourself an expert in navigating...

by Mara Calvello

by Mara Calvello